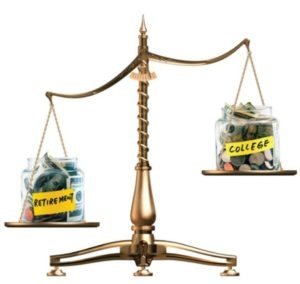

Balancing College and Retirement

Are you faced with the dilemma of saving for your own retirement while at the same time trying to put money away for a child’s college education? How do you pursue both goals? How do you determine which is more important or what path to take?

If this hard choice sounds familiar, you’re not alone. Many Americans today struggle to balance their own financial future with preparing their children for success. As financial professionals, we have helped many parents evaluate their options and choose the path that makes sense for their situation.

First of all, keep in mind that there are no simple answers that work for everyone. Some questions that can help guide your thinking might be:

- How many years until you retire?

- How much income do you expect to need in retirement?

- How much do you expect to receive from Social Security?

- Do you have to send multiple children to college?

- How many years until your child goes to college?

- How much do you expect your child to spend on college?

- Do you think your child will qualify for financial aid? (Filling out the FAFSA now can help)

- How should you and your child split college costs?

- What actions can your child take now and later to reduce college costs?

If you’ve run the numbers on both your anticipated retirement and college expenses and come up short, what do you do? It’s time to sit down and make some tough decisions about your expectations and what you can do to compromise. Consider these questions:

- Do you need to adjust your current lifestyle to save more?

- Do you need to reduce your retirement lifestyle?

- Can you contribute less to your child’s college costs?

- Can your child take on a larger financial burden?

- Can your child do more to make college cheaper?

For many parents, helping their children with college costs is a major financial goal. However, helping your children doesn’t mean footing the whole bill. One of the most valuable contributions parents can make to their children’s future is teaching them how to make smart financial decisions by weighing the costs and benefits of their choices. Sit down with your children and talk about your shared expectations about college as early as possible. Armed with that information, your family can make the best decision possible.

Keep this in mind: While your child can get financial aid for college, there is no financial aid for retirement. While college savings are important, focusing on your own retirement should take precedence. Short-changing your retirement savings could end up costing you big-time down the road.

If saving for both goals is deeply important to you, contact us to discuss your options. While we are not miracle workers, we may help you prioritize the financial goals that are most important to you. Sometimes, making changes to your financial strategies or spending patterns can help you free up money and increase your savings. As with all important financial decisions, it’s best to talk with a financial professional to determine the appropriate course of action, and to make sure you’re on track to meet your goals.

If we can help you understand your retirement and college planning options, please contact us at for a personal consultation.

Bravias Financial is an independent financial advisory firm. Investment Advisory Services offered through AlphaStar Capital Management, LLC, a SEC Registered Investment Advisor. AlphaStar Capital Management, LLC and Bravias Financial are independent entities. These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.