A SEASON OF CHANGE

You have probably heard it said before, “sell in May and go away”. This old stock market cliché refers to an anomaly known as seasonality. Its basic tenet instructs investors to hold stocks during the months of November through April. Then, stocks are sold and replaced with bonds in the other six-months. Contrary to efficient market theory, stocks have been found to perform extremely well in the best six months and become laggards in the worst six-months.

Admittedly, a wholly dedicated strategy to seasonality would not constitute a prudent financial plan. It can be quite costly to be out of stocks during their best performing month. Assuming, that month occurs on or between May and October; long-term wealth goals will be penalized by missing those stock returns. However, the two middle quarters of 2017 are uniquely packed with upcoming events that might warrant some form of a risk-management strategy. Our diversified, actively managed approach strives to provide prudent risk management in these environments.

Legislators in Washington D.C. just experienced a demoralizing blow. Speaker of the House, Paul Ryan canceled a vote on repealing and replacing certain parts of the Affordable Care Act, because not all House Republicans could agree on the bill. The House Republican divide further raised suspicion that complex legislation like tax reform and de-regulation could also encounter its own obstacles. Coincidently, stocks in the industrial average put up eight straight days of losses surrounding the canceled vote.

European events continue to gather much attention. Prime Minister, Theresa May just notified the European Council of Britain’s official intent to exit the union. Once approved, the time-table for exit is set in motion. The French cast their first round of votes for their next president in the last half of April. Although, unexpected to win, Marine Le Pen, a presidential candidate, is a staunch critic of the European Union, and advocates for a French exit. Plenty of issues remain in the spotlight that keeps the region in a state of post-recession fragility, such as its anti-establishment movements and ailing banks and economies in Europe’s southern regions,

Although, it is not all alarming news for Europe. Euro- area unemployment has retrenched to its lowest level since 2009, and prices of goods and services are finally reflating albeit slowly. Dutch voters managed to avoid electing a prime minister who campaigned for a divorce between the Netherlands and the European Union. Lastly, Angela Merkel is expected to be re-elected as the Chancellor of Germany in the September elections.

Despite the European economic and political seesaw and the tough policy decisions that the European Central Bank will soon have to answer, European stocks have put up impressive gains this year. Also, the Euro currency continues to show its strength against the US dollar.

Lastly, the Federal Open Market Committee (FOMC) enters a period of acute policy decision making. They recently rose the cost of borrowing on excess bank reserves to 0.75%-1.00%, and will be looking to make additional increases throughout the year. Yet, the last thing the FOMC wants to do is tip the economy into recession by raising rates too fast. But, the FOMC confronts multiple opposing factors in future policy meetings. One, rarely has the rate of inflation and wage growth been so slow when unemployment has been so low. Second, poor productivity impedes how quickly rates can rise. Finally, the FOMC must counterbalance any type of fiscal stimulus that could come from public policy. The next FOMC meeting is scheduled for early May.

Market Movers

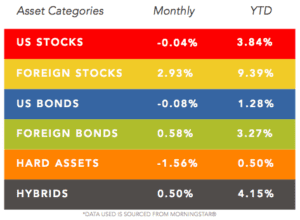

Foreign assets clearly outperformed in March in both the equity and fixed income markets. This is another good reminder of the power of global diversification. These assets have come down in value rather significantly over the last few years due to political and economic uncertainty. Although much of this risk remains, select foreign investments appear attractive. The primary benchmarks for our Core Allocation portfolios are Morningstar’s World Allocation and Tactical Allocation categories of managers. The Core models continue to offer attractive returns on a risk adjusted basis relative to these benchmarks. The asset allocation decisions continue to be the primary driver of return for our Core portfolios. Our investment team continues to closely monitor the evolving global landscape in search of opportunity.

US STOCKS were flat in March, underperforming their foreign counterparts rather significantly. US equities came under pressure in part because of the political environment surrounding the Affordable Care Act. Large-Caps (VUG, VTV) outperformed mid and small cap. Our recently elevated large cap exposure helped mitigate some of the nominal losses in smaller cap stocks.

FOREIGN STOCKS had a very strong month and have offered almost three times the returns of US Stocks since the beginning of the year. Emerging Markets (VWO) specifically have rebounded very nicely. Our increased allocation to Emerging Markets at the beginning of the year continues to add value. We’ve also maintained a sizeable foreign equity allocation despite some of the perceived risk. This also has driven portfolio returns since the beginning of the year.

US BONDS traded pretty much flat in March. Since the beginning of the year, this market segment has been uninspiring. However, our focus on less traditional bond sectors, such as High Yield (JNK) and Bank Loans (BKLN), has been beneficial. Traditional high quality bonds are under pressure due to low interest rate levels and the threat of a rising rate environment. Our approach involves more flexibility where we can seek out more attractive yield sources in the US Bond market.

FOREIGN BONDS made modest gains in March, but significantly outperformed US Bonds. Emerging Market debt (PCY) outperformed developed country bonds. We have been avoiding developed country bond exposure in our strategies due to the extremely low yields and risk in these markets. Emerging market debt on the other hand provides attractive income while also offering important diversification relative to the other asset classes. This allocation decision continues to drive our portfolio returns.

HARD ASSETS were the worst performing category in March, but primarily due to the energy sector. However, our use of Master Limited Partnerships (AMJ) for the energy exposure in our portfolios was critical as this holding provided positive returns since the beginning of the year. In addition, our use of Precious Metals (IAU) and Global Real Estate (RWO) added value. Hard Asset exposure continues to be an area of focus for us with the goal of providing diversifying benefits and return potential.

HYBRIDS provided more attractive returns relative to both US Bonds and US Stocks since the beginning of the year. Convertible Debt (CWB) and Variable Preferred Stock (VRP) together provide helpful exposure in light of the current interest rate environment. These often overlooked assets have helped us manage risk and drive returns in our portfolios.