Weekly Market Insight: No Stimulus, Stocks Lower

The Week on Wall Street

The failure to reach an agreement on a new fiscal stimulus bill soured investor sentiment and sent stocks modestly lower for the week.

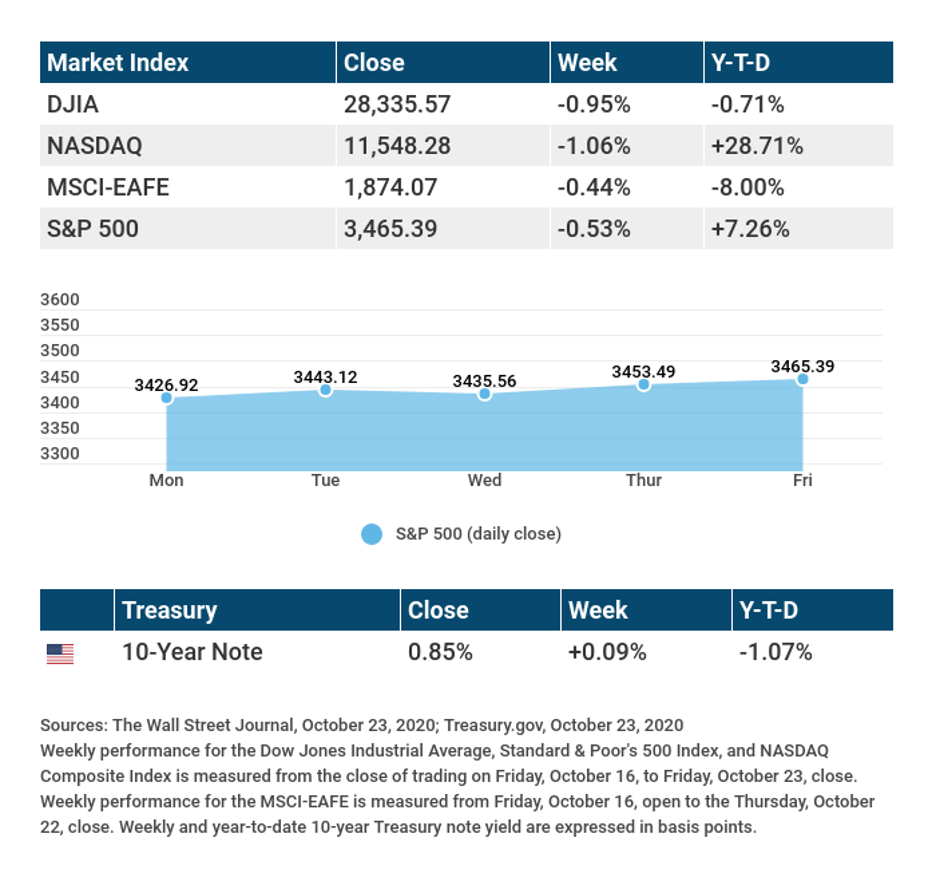

The Dow Jones Industrial Average fell 0.95%, while the Standard & Poor’s 500 lost 0.53%. The Nasdaq Composite index slipped 1.06% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, declined 0.44%.[i],[ii],[iii]

Markets Disappointed with Stimulus Impasse

Stock prices ebbed and flowed all week, pulled by the gravity of fiscal stimulus talks in Washington, D.C. As investors saw improving prospects for a new fiscal stimulus bill, stocks rose. As prospects dimmed, stocks turned lower.

Hopes for striking a deal were raised late in the week as comments from a key negotiator suggested that a deal might be getting closer to fruition. The week ended, however, without an agreement, cementing a disappointing week of performance.

Market sentiment was further weighed down by the continued rise in COVID-19 cases in the U.S. and Europe, though anxieties were tempered by the belief that a full economic lockdown was unlikely.

New Jobless Claims Fall

Markets have been focused on weekly initial jobless claims as an important input into the state of economic recovery. After weeks of 800,000+ new jobless claims, last week’s report reflected an improving labor market, as new jobless claims rose by 787,000, below consensus estimates of 875,000, while continuing jobless claims fell by more than one million.[iv]

The report wasn’t entirely positive, however, as more than 500,000 individuals were added to the emergency assistance program that extends unemployment benefits to those who have run out of state unemployment benefits.[v]

THIS WEEK: KEY ECONOMIC DATA

Monday: New Home Sales.

Tuesday: Durable Goods Orders. Consumer Confidence.

Thursday: Gross Domestic Product (GDP). Jobless Claims.

Friday: Consumer Sentiment.

Source: Econoday, October 23, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: Twilio, Inc (TWLO).

Tuesday: Microsoft (MSFT), Pfizer (PFE), Caterpillar (CAT), Merck (MRK), Eli Lilly (LLY), 3M Company (MMM), Corning Inc. (GLW)

Wednesday: General Electric (GE), The Boeing Corporation (BA), Ford Motor Company (F), Visa (V), Mastercard (MA), Gilead Sciences (GILD), Blackstone Group (BX), Amgen (AMGN), United Parcel Services (UPS), EBay (EBAY), Norfolk Southern (NSC)

Thursday: Apple (AAPL), Facebook (FB), Twitter (TWTR), Alphabet, Inc. (GOOGL), Southern Company Airlines (SO), Shopify (SHOP), Comcast Corporation (CMCSA), AnheuserBusch InBev (BUD)

Friday: Abbvie (ABBV), Chevron (CVX), Charter Communications (CHTR)

Source: Zacks, October 23, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.Diversification does not guarantee profit nor is it guaranteed to protect assets. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896. The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment decision. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information. By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[i] The Wall Street Journal, October 23, 2020

[ii] The Wall Street Journal, October 23, 2020

[iii] The Wall Street Journal, October 23, 2020

[iv] CNBC, October 22, 2020

[v] CNBC, October 22, 2020