Weekly Market Insight: Fed Cuts Rates, Stocks Retreat

The Week on Wall Street

Last week, the Federal Reserve cut interest rates for the first time in more than a decade, in line with Wall Street’s expectations. Ironically, stocks had their worst week of 2019.

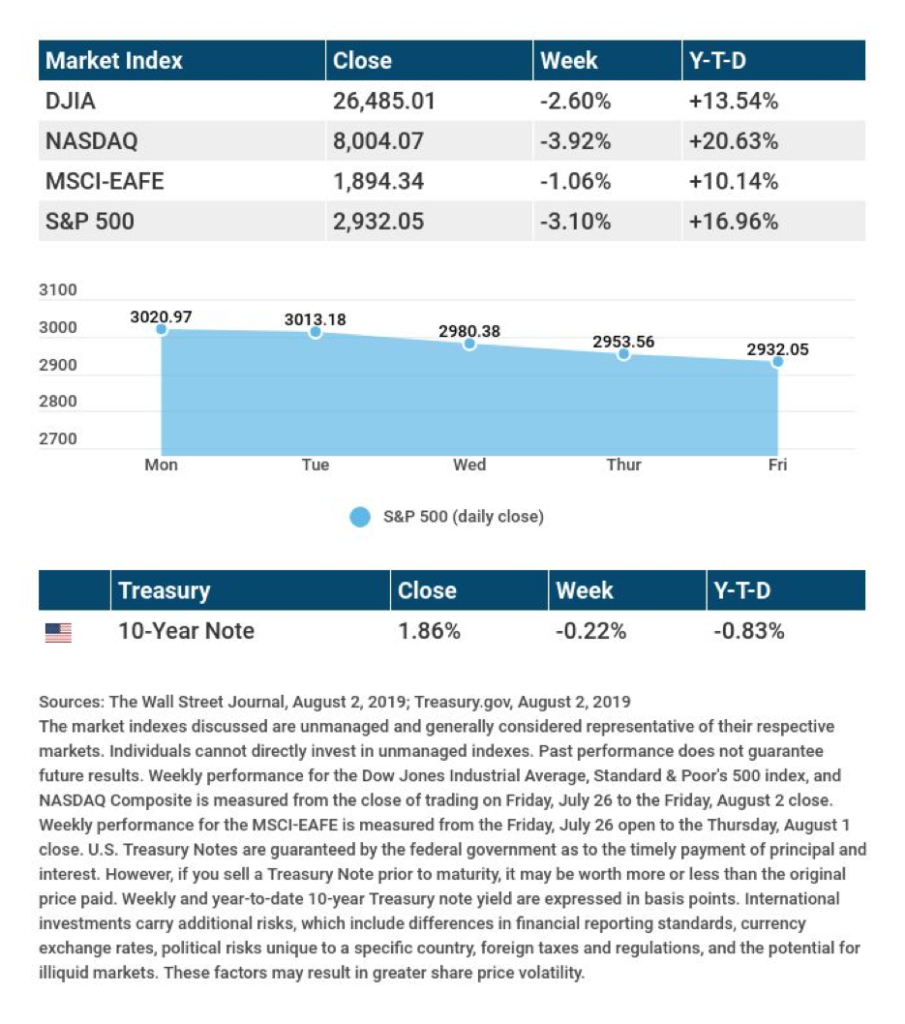

The S&P 500 finished the week 3.10% lower. The Dow Jones Industrial Average and the Nasdaq Composite also posted weekly losses; the blue chips fell 2.60%, while the premier tech benchmark slumped 3.92%. International stocks tracked by MSCI’s EAFE index dipped 1.06%.[1],[2],[3]

Fed Cuts Benchmark Interest Rate

On Wednesday, the central bank reduced the federal funds rate by 0.25%. The latest Fed policy statement noted that “global developments” and “muted inflation” influenced the decision.

Addressing the media, Fed Chairman Jerome Powell described the cut as a “mid-cycle adjustment.” After that comment, Wednesday’s trading session turned volatile on the interpretation that the cut was a “one and done” move, instead of what might be the first in a series.[iv]

More Tariffs Planned

Shares also fell Thursday, after a White House tweet indicated that the U.S. would put a 10% tariff on another $300 billion of goods coming from China, effective September 1.

Practically speaking, this would mean a tariff on nearly all Chinese products arriving in America. So far, the announcement has not affected plans for trade delegates from both nations to continue negotiations in September.[v]

The Latest Hiring Data

Payrolls expanded with 164,000 net new jobs in July, according to the Department of Labor. The headline jobless rate stayed at 3.7%; it has now been under 4% for 17 months. The U-6 jobless rate, which counts both underemployed and unemployed Americans, dipped to 7.0%, a level unseen since December 2000.

Monthly job growth has averaged 140,000 over the past three months, compared to 187,000 in 2018.[vi]

THE WEEK AHEAD: KEY ECONOMIC DATA

Monday: The Institute for Supply Management releases its latest Non-Manufacturing Purchasing Managers Index, its monthly gauge of business activity in America’s service sector.

Source: Econoday / MarketWatch Calendar, August 2, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Marriott International (MAR), Tyson Foods (TSN)

Tuesday: Walt Disney Co. (DIS)

Wednesday: American International Group (AIG), CVS Health (CVS)

Thursday: Booking Holdings (BKNG), Uber (UBER)

Source: Zacks, August 2, 2019

Companies mentioned are

for informational purposes only. It should not be considered a solicitation for

the purchase or sale of the securities. Any investment should be consistent

with your objectives, time frame and risk tolerance. The return and principal

value of investments will fluctuate as market conditions change. When sold,

investments may be worth more or less than their original cost. Companies may

reschedule when they report earnings without notice.

[1]https://www.apnews.com/e15c18b9dbc44efab400d2214e2cb6f9

[2]https://www.wsj.com/market-data

[3]https://quotes.wsj.com/index/XX/990300/historical-prices

[iv]https://www.forbes.com/sites/jjkinahan/2019/07/31/feds-quarter-point-rate-cut-weak-global-growth-trade-tensions-muted-inflation-cited

[v]https://www.cnn.com/2019/08/01/investing/asian-market-latest-trade-war/index.html

[vi]https://www.cnn.com/2019/08/02/economy/july-jobs-report/index.html