Weekly Market Insight: Higher Tariffs Take Effect

The Week on Wall Street

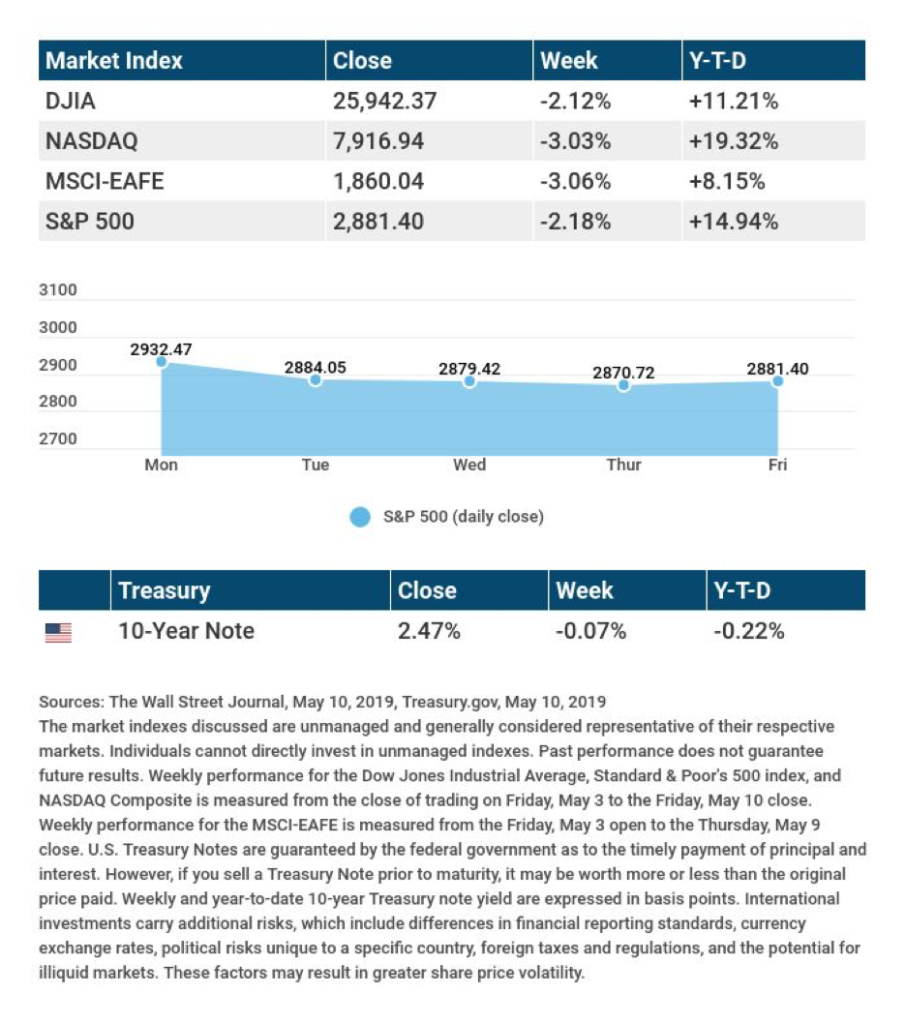

As we noted recently, Wall Street has a wandering eye. Last week, it focused on the new tariff threats in the ongoing U.S.-China trade dispute. Stocks fell across five trading sessions: the Dow Jones Industrial Average lost 2.12%, the S&P 500, 2.18%; the Nasdaq Composite, 3.03%. International stocks also fell: the MSCI EAFE index declined 3.06%.

Earnings and big-name initial public offerings mattered little last week. Traders were more concerned about how consumers and corporations might be affected by higher import taxes in future quarters.[1],[2]

Tariffs Increase

At 12:01 a.m. Friday, duties on $200 billion worth of Chinese products coming to the U.S. rose from 10% to 25%. Just days earlier, President Trump had tweeted that the U.S. might also tax another $325 billion of Chinese imports, mainly consumer goods.

While the proposed new taxes might take months to implement, institutional investors reacted negatively to this information, perceiving that trade talks were stalled.[3],[4]

Final Thought

A few weeks ago, market watchers noted the huge number of initial public offerings anticipated for 2019. One well-known tech firm completed its IPO on Friday, and the wave of tech IPOs is still building. According to research firm CB Insights, the average stock market valuation of the venture-capital-backed tech companies going public this year is $9.6 billion.[5]

THE WEEK AHEAD: KEY ECONOMIC DATA

Wednesday: April retail sales figures from the Census Bureau.

Friday: The University of Michigan’s preliminary May consumer sentiment index, a measure of consumer confidence.

Source: Econoday / MarketWatch Calendar, May 10, 2019

The Econoday and MarketWatch economic calendars list upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Take-Two Interactive (TTWO)

Tuesday: Agilent (A), Ralph Lauren (RL)

Wednesday: Alibaba (BABA), Cisco (CSCO), Macy’s (M)

Thursday: Applied Materials (AMAT), Nvidia (NVDA), Walmart (WMT)

Friday: Deere & Co. (DE)

Source: Morningstar.com, May 10, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Diversification does not guarantee profit nor is it guaranteed to

protect assets. International

investing involves special risks such as currency fluctuation and political

instability and may not be suitable for all investors. The Standard & Poor’s 500

(S&P 500) is an unmanaged group of securities considered to be

representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted average of 30

significant stocks traded on the New York Stock Exchange and the NASDAQ. The

DJIA was invented by Charles Dow back in 1896. The Nasdaq Composite is an index of the common stocks and similar

securities listed on the NASDAQ stock market and is considered a broad

indicator of the performance of stocks of technology companies and growth

companies. The MSCI EAFE Index was created by Morgan Stanley Capital

International (MSCI) that serves as a benchmark of the performance

in major international equity markets as represented by 21 major MSCI

indices from Europe, Australia, and Southeast Asia. The 10-year Treasury

Note represents debt owed by the United States Treasury to the public. Since

the U.S. Government is seen as a risk-free borrower, investors use the 10-year

Treasury Note as a benchmark for the long-term bond market. Opinions expressed are subject

to change without notice and are not intended as investment advice or to

predict future performance. Past

performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment

decision. Fixed income

investments are subject to various risks including changes in interest rates,

credit quality, inflation risk, market valuations, prepayments, corporate

events, tax ramifications and other factors. These are the views of Platinum Advisor Strategies, LLC, and not

necessarily those of the named representative, Broker dealer or Investment

Advisor, and should not be construed as investment advice. Neither the named

representative nor the named Broker dealer or Investment Advisor gives tax or

legal advice. All information is believed to be from reliable sources; however,

we make no representation as to its completeness or accuracy. Please consult

your financial advisor for further information. By clicking on these links, you will leave our server, as the links are

located on another server. We have not independently verified the information

available through this link. The link is provided to you as a matter of

interest. Please click on the links below to leave and proceed to the selected

site.

[1] https://www.wsj.com/market-data

[2] https://quotes.wsj.com/index/XX/990300/historical-prices

[3] https://www.cnn.com/2019/05/10/business/china-us-tariffs-trade/index.html

[4] https://www.cnbc.com/2019/05/07/if-trump-slaps-china-with-all-the-tariffs-threatened-it-could-be-the-us-consumer-that-pays.html

[5] https://www.nytimes.com/interactive/2019/05/09/business/dealbook/tech-ipos-uber.html