Weekly Market Insight: Stocks Have Mixed Reaction

The Week on Wall Street

Stocks were mixed last week amid a busy week of earnings, some troubling economic data, and seemingly little progress on a new fiscal stimulus package.

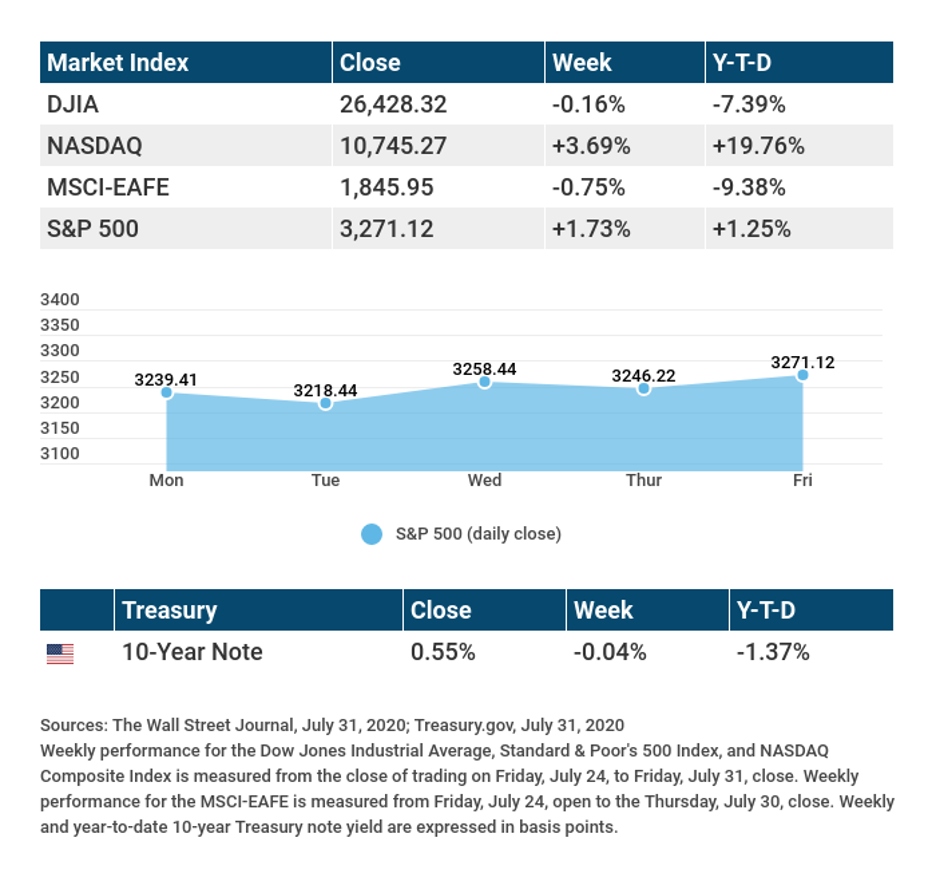

The Dow Jones Industrial Average slipped 0.16%, while the Standard & Poor’s 500 increased by 1.73%. The Nasdaq Composite Index surged 3.69% for the week. The MSCI EAFE Index, which tracks developed stock markets overseas, dipped 0.75%.[1],[2],[3]

Stocks Buffeted by Crosswinds

Stocks rode a roller coaster last week, reacting to a conflicting stream of corporate events and economic data.

Investors were optimistic on Monday about the ability of mega-cap technology companies to thrive in an uncertain economy, but worried on Tuesday about pending Congressional testimony involving the CEOs of these firms.

On the economic front, a strong June durable goods orders report on Monday bolstered investor sentiment. But the optimism faded on a disappointing jobless claims number and a troubling second-quarter GDP number that—while anticipated—was a bit unsettling.[4],[5],[6]

Following some exceptional earnings results from the mega-cap technology companies, stocks managed to rally in the final hour of trading on Friday.

U.S. Dollar Continues Its Decline

Since peaking in mid-March, the U.S. dollar has dropped nearly 9%. Some of the potential beneficiaries of a weak dollar are global American businesses whose products and services become less expensive in overseas markets.[7]

Conversely, international companies may suffer lower sales in the U.S. as their products become more expensive. It’s a mixed bag of potential outcomes, but Wall Street has become more and more focused on the dollar’s trajectory.

Final Thoughts

August has historically been a particularly volatile month. For instance, in 2019, the S&P 500 posted moves of more than one percent in 22 trading days.[8]

One of the possible reasons is that many traders are away on vacation, resulting in light volume, which may amplify market volatility. But this year, it’s uncertain whether traders will be away on vacation due to the pandemic. Should markets become volatile in the weeks ahead, investors may want to remind themselves of the seasonal trends that may be at work.

THIS WEEK: KEY ECONOMIC DATA

Monday: Purchasing Managers Index (PMI) Manufacturing Index. Institute for Supply Management (ISM) Manufacturing Index.

Wednesday: Automated Data Processing (ADP) Employment Report. Purchasing Managers Index (PMI) Services Index. Institute for Supply Management (ISM) Non-Manufacturing Index.

Thursday: Jobless Claims.

Friday: Employment Situation Report.

Source: Econoday, July 31, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THIS WEEK: COMPANIES REPORTING EARNINGS

Monday: The Clorox Company (CLX), American International Group (AIG).

Tuesday: The Walt Disney Company (DIS), Twilio (TWLO), Prudential Financial (PRU), Emerson Electric (EMR).

Wednesday: CVS Health (CVS), Humana (HUM), Regeneron Pharmaceuticals (REGN), Wayfair (W).

Thursday: Bristol Myers Squibb (BMY), Booking Holdings (BKNG), Becton Dickinson (BDX), T-Mobile (TMUS).

Source: Zacks, July 31, 2020

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.Diversification does not guarantee profit nor is it guaranteed to protect assets. International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. The DJIA was invented by Charles Dow back in 1896. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indices from Europe, Australia, and Southeast Asia. The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. You cannot invest directly in an index. Consult your financial professional before making any investment decision. Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors. These are the views of Platinum Advisor Strategies, LLC, and not necessarily those of the named representative, Broker dealer or Investment Advisor and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information. By clicking on these links, you will leave our server, as the links are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

[1] The Wall Street Journal, July 31, 2020

[2] The Wall Street Journal, July 31, 2020

[3] The Wall Street Journal, July 31, 2020

[5] CNBC.com, July 30, 2020

[6] BEA.gov, July 30, 2020

[7] Reuters.com, July 28, 2020

[8] CNBC.com, August 31, 2019