Dollar Cost Averaging

Volatility is part and parcel of being a stock investor. Many investors go wrong when they try to outsmart market movements by timing buying and selling. Unfortunately, research has shown that market timing may hurt your portfolio performance over time.

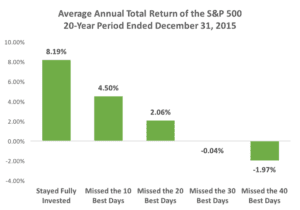

Not only do investors tend to sell when prices are down and buy when markets are nearing peaks (the precise opposite of what they should do), they often miss out on the best days of performance by being on the sidelines when markets move.

The chart below shows the effects of missing the best days of the market in the 20-year period between 1996 and 2015:[i]

Source: Standard & Poor’s

Rather than trying to outguess the market, why not consider an investment strategy that takes advantage of its highs and lows? Dollar-cost averaging is an investment approach based on diligence and discipline that doesn’t rely on correctly picking market highs and lows.

If you’re a long-term investor, volatility and market corrections may offer buying opportunities. Dollar-cost averaging can help reduce your anxiety about investing during periods of turbulence. Simply put, dollar-cost averaging means investing the same fixed amount of money at regular intervals.

For example, you might choose to invest $500 or more on the first of every month. Regardless of whether the market is doing well or poorly, you continue to invest $500 at the same time each month, eliminating any decisions about timing.

The idea is to invest consistently and take advantage of market fluctuations to “average” out the price you pay for the shares you purchase. In effect, this method allows you to purchase more shares when the prices are low and fewer when share prices are high. This disciplined technique can help reduce the risk that you will chase performance and repeatedly purchase shares when the price is high or miss out on market movements by selling when prices decline.

There are some potential pitfalls to consider. Dollar-cost averaging requires you to adhere to a disciplined approach of investing on a regular basis, even in a declining market, which can test your mettle as an investor. You need to consider your financial ability to dollar-cost average through changing market cycles. It’s also important to remember that dollar-cost averaging is simply a risk-mitigation strategy; it doesn’t guarantee a profit or protect against loss during a declining market.

[1] https://www.franklintempleton.com/forms-literature/download/GOF-FL5VL

The S&P 500 is an unmanaged composite index considered to be representative of the U.S. stock market in general. All index returns include reinvested dividends but may exclude fees, investment costs and taxes. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. For illustrative purposes only. These are the views of Platinum Advisor Marketing Strategies, LLC, and not necessarily those of Bravias Financial, and should not be construed as investment advice. Neither the named representative nor the named Broker dealer or Investment Advisor gives tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information.