Market Review – June 2017

“ADAPTIVE EXPECTATIONS”

“There’s an app for that,” so goes the buzz-phrase, which was created and later trademarked by a technology juggernaut. The expression describes a software revolution found inside smartphones and tablets. Now, as quantitative strategies pile into portfolios, investors will probably start saying, “there’s a quant for that”. The idea behind ‘quantitative strategies’ is to make investment decisions based on algorithms or some other form of automated, computer-driven model. This can take the ‘art’ out of the investment process, which isn’t necessarily a good thing.

Traditional stock trading volume by banks and asset managers has been declining over the past number of years. The slack, however, is being picked up by quantitatively focused trading rms. In the hedge-fund business, net money flows into quantitative strategies rose $13 billion last year whereas traditional strategies experienced out flows of $83 billion. Smart beta ETFs (a term used to de ne quantitative investment selections) is another area of growing popularity. Their assets under management have quintupled in the last decade.

An example of a quantitatively-focused strategy is trading based on market volatility. It is a common belief that growth stocks exhibit greater price variation than value stocks. A strategy executed by institutions is then to purchase value stocks with borrowed money when financial markets are calm and lending conditions are ripe. This strategy can enhance returns and limit downside risk. However, when financial conditions are tighter than average, impediments to borrowing make it harder to buy securities on margin. The next best option for returns is to purchase growth stocks.

To see the volatility strategy in action, look back to the last financial crisis. The Chicago Fed National Financial Conditions Index reports that liquidity and leverage conditions were tighter than average surrounding the deepest part of the recession. During this period, large- cap growth stocks outperformed large-cap value stocks by almost .4% per month. Since then, financial conditions have been looser than average and the outperformance of growth stocks has narrowed to an average of roughly .15% per month.

Another common quantitative strategy strives to time market cycles. For example, momentum strategies (the idea of buying investments with recent strong performance) are found to do well in complacent markets and poorly in turbulent markets.

Exchange-traded-funds and quantitative investing are revolutionizing traditional stock picking. Historically, many of the large money managers avoided quantitative research and rather focused on fundamental analysis. Fundamental research involves scouring nancial statements and speaking to customers and management. But, as the popularity of quantitative trading increases, returns will certainly diminish as large amounts of money chase the same thing. Someday as this happens, traditional fundamental analysis can regain popularity.

However, certain fundamental analysis techniques have seemingly led to consistently strong investment performance. For example, dividend yields plus share buyback yields have revealed a close t between stock market performance and overall economic growth. Therefore, it can be interpreted that income growth is fundamentally important to future stock market returns. According to Yardeni Research, the income yield from dividends and share buybacks of the largest 500 US companies resides around 5% per year. For now, the income yield likely represents the future return expectation for stocks and a benchmark that quantitative rms will attempt to overcome. The point is that just because a particular investment approach works today, it doesn’t mean that same methodology will work forever. Markets and investors adapt.

Market Movers

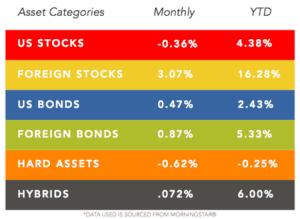

Foreign Equity was the winning category in the month of May. Foreign stocks are also the hottest category in 2017 with year-to-date gains over 16%, compared with roughly a 4% return for US Equity. Global monetary stimulus and improving economic activity are offering a stable climate for investments. The Core Allocation models continue to outperform their benchmarks, Morningstar World Allocation and Morningstar Tactical Allocation. The Investment Team’s decision to increase portfolio exposure to emerging market equity is a big contributor to the strategy’s strong performance. The Investment Team continues to monitor the volatility of equity prices, the direction of commodity prices, and geopolitical headlines as events unravel. Despite a few recent currency and corruption scares in emerging economies, money continues to ow into emerging stocks.

US STOCKS lost ground in May. The category was weighed down by Small-Caps (IJR) pulling back nearly 2%. Large-Cap (IVV) stocks ended the month with a gain. They were pulled up primarily by the technology sector. The Core Allocation’s bias to Large-Caps has delivered excess return to the strategy this year.

FOREIGN STOCKS won the ‘horserace’ once again. Large-Caps (VEA) and Small/Mid-Caps (VSS) outperformed Emerging Markets (VWO) by nearly 1%. Emerging Markets hit a bit of a snafu in late May. Government shenanigans in Brazil and currency volatility in Turkey, South Africa, and Mexico gave investors a quick scare. However, things calmed down and money poured back into these markets.

US BONDS made small gains in May. Investment Grade (VCIT) and High Yield (JNK) credit sectors led the category. Government Bond (VGLT) prices rose as interest rates slid. Inflation Protected Bonds lost value. The conventional wisdom at the beginning of the year to shorten maturities and hedge against rising consumer prices has not exactly come to fruition. The Core Allocation’s use of longer dated Government Bonds and exclusion of Inflation Protected Bonds has greatly benefited the overall bond allocation.

FOREIGN BONDS posted another gain last month. Money flows into World Bonds outpaced Emerging Market Bonds (PCY) for a change. Even though European bank officials hinted that their own quantitative easing programs are nearing an end, this was not enough to spook investors. Investors remain sold that risks are lowering and economic activity is strengthening. The Core Allocation’s exposure to Emerging Treasuries (PCY) continues to add value.

HARD ASSETS were a mixed bag last month. Precious Metals (IAU) slid ever so slightly and Energy dropped again. Global Real Estate (RWO) was the only winner. On the year, Precious Metals and Real Estate are the only two gainers. Despite the Energy sector being down 16% altogether, the Core Allocation’s position to MLPs (AMJ) has lost only a fraction of the total losses of Energy.

HYBRIDS made another month of modest gains. Again, the category is performing better than traditional bonds. On the year, Hybrids have outperformed traditional bonds by over 3%. The Core Allocation’s positions to Variable Rate Preferred (VRP) and Convertible Bonds (CWB) continues to enhance total return while also keeping a focus on risk management.