Volatile Markets Continue

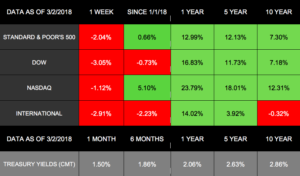

Volatility continued last week as markets posted their 1st weekly loss in 3 weeks.[i] Despite some recovery on Friday, the S&P 500 dropped 2.04%, the NASDAQ slipped 1.12%, and the Dow lost 3.05% for the week.[ii] Internationally, the MSCI EAFE fell 2.91%.[iii]

Last week’s ups-and-downs began with continued questions over whether the Fed will raise interest rates. By the week’s end, however, rumors of an international trade war dominated the attention of investors.

Fed Suggests Raising Interest Rates

New Fed Chair Jerome Powell testified on Tuesday that inflation and a strong economy may lead to interest rate hikes sooner than expected.[iv] Whether the Fed will impose a 4th hike this year caused investor uncertainty and led to mid-week market drops.[v] Powell noted, however, that increased market volatility will not influence the Fed’s decisions regarding rate increases.[vi]

Trump Announces Tariffs on Imports

Investor attention shifted on Thursday as President Trump announced plans to impose a 25% tariff on steel and a 10% tariff on aluminum imports.[vii] While the move could protect American metal workers, some analysts worry it may also trigger a possible trade war.[viii]

Countries around the world reacted to the news, with some announcing their own plans for U.S. tariffs in response.[ix] Over the weekend, the President reacted by noting possible tariffs on imported autos, where the U.S. has a deficit. Some analysts worry this could further hurt an already negative trade gap in our Gross Domestic Product (GDP).[x]

Signs of Strength

Despite the developments with tariffs and rising interest rates, we did receive encouraging economic reports:

-

Strong Consumer Sentiment: Last month’s consumer sentiment report hit its 2nd highest recording in over 10 years. Upon the approved tax bill, companies gave nearly $30 billion in bonuses, boosting consumer incomes and attitudes.[xi]

Outstanding Jobless Claims: Last week’s reported jobless claims were the lowest in 49 years. A healthy demand for labor and few layoffs have helped keep unemployment numbers low.[xii]

What’s ahead?

Expect more market volatility going forward as investors follow the Fed’s interest rate plans to keep potential inflation in check. The President has also promised to announce specific details concerning the proposed new tariffs this week.[xiii] If you have questions concerning how these developing economic policies may impact your financial life, we are always here to help.

ECONOMIC CALENDAR

Monday: ISM Non-mfg Index

Tuesday: Factory Orders

Wednesday: ADP Employment Report

Thursday: Jobless Claims

Click on above image to enlarge

Notes: All index returns (except S&P 500) exclude reinvested dividends, and the 5-year and 10-year returns are annualized. The total returns for the S&P 500 assume reinvestment of dividends on the last day of the month. This may account for differences between the index returns published on Morningstar.com and the index returns published elsewhere. International performance is represented by the MSCI EAFE Index. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

[i] https://www.cnbc.com/2018/03/02/us-stock-futures-dow-data-earnings-fed-and-politics-on-the-agenda.html

[ii] http://performance.morningstar.com/Performance/index-c/performance-return.action?t=SPX®ion=usa&culture=en-US

http://performance.morningstar.com/Performance/index-c/performance-return.action?t=@CCO

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://www.usatoday.com/story/money/markets/2018/03/02/world-markets-fret-over-trade-war-after-trumps-tariff-vow/388182002/

[v] https://www.usatoday.com/story/money/markets/2018/02/28/fed-chiefs-rate-talk-puts-stocks-bind/378755002/

[vi] https://www.cnbc.com/2018/02/27/fed-chairman-powell-market-volatility-wont-stop-more-rate-hikes.html

[vii] https://www.usatoday.com/story/money/markets/2018/03/02/world-markets-fret-over-trade-war-after-trumps-tariff-vow/388182002/

[viii] https://www.cnbc.com/2018/03/01/forex-markets-focus-on-dollar-moves-after-trump-tariff-decision.html

[ix] https://www.reuters.com/article/us-usa-trade/trade-wars-are-good-trump-says-defying-global-concern-over-tariffs-idUSKCN1GE1PM

[x] https://www.bloomberg.com/news/articles/2018-03-02/trump-opens-door-to-trade-war-as-eu-threatens-iconic-u-s-brands

[xi] https://www.bloomberg.com/news/articles/2018-03-02/consumer-sentiment-in-u-s-at-second-highest-level-since-2004

[xii] http://wsj-us.econoday.com/byshoweventfull.asp?fid=485207&cust=wsj-us&year=2018&lid=0&prev=/byweek.asp#top

[xiii] https://www.reuters.com/article/us-usa-trade/trade-wars-are-good-trump-says-defying-global-concern-over-tariffs-idUSKCN1GE1PM